Call option value calculator

You can use this Black-Scholes Calculator to determine the fair market value price of a European put or call option based on the Black-Scholes pricing model. However the call option value as seen on the NSE option chain is.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

A Call option represents the right but not the requirement to purchase a set number of shares of stock at a pre-determined strike price before the option reaches its expiration date.

. In the black-scholes model the value of a european call option with strike k k expiring in t t years from today on a stock with a current price of s s and dividend yield of q q is given by c. Free Option Calculator based on Black-Scholes with Call and Put Prices Greeks and Implied Volatility Calculation. Ad Smart Options Strategies shows how to safely trade options on a shoestring budget.

The calculator is suggesting the fair value of 8100 call option should be 8114 and the fair value of 8100 put option is 7135. This app calculates the gain or loss from buying a call stock option. Download Smart Options Strategies free today to see how to safely trade options.

See how this trading course helps small investors earns Extra Income. The long call calculator will show you whether or not your options are at. Change any of the sliders.

When purchasing a call option you are buying the right to purchase a stock at. Lets say we have a call option on IBM stock with a price of 15. It also calculates and.

154 out-of-the-money About The Option Value Calculator Black-Scholes This tool lets you value European put and call options using the Black-Scholes model. The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option contract using your. See how this trading course helps small investors earns Extra Income.

The GE 30 call option would have an intrinsic value of 480 3480 - 30 480 because the option holder can exercise the option to buy GE shares at 30 then turn. Our option calculator lets you estimate the future fair price of an option by different pairs of implied volatility and underlying price. We support the calculation of American.

Open an Account Now. Suppose Jane bought call options for a. The gain or loss is calculated at expiration.

Options involve risk and are not suitable for all investors. Call option profit or loss 150. Ad Heres how ordinary people are earning 5000 - 20000 each month in their spare time.

Ad Heres how ordinary people are earning 5000 - 20000 each month in their spare time. Calculate a multi-dimensional analysis. Try Premium for Free Today.

Black-Scholes Calculator for the Value of a Call Option This calculator uses the Black-Scholes formula to compute the value of a call option given the options time to maturity and strike. Option Price Delta Gamma Calculator This calculator utilizes the inputs below to generate call put prices delta gamma and theta from the Black-Scholes model. With this options calculator you can find the theoretical price for both call and put options.

As a derivative product options derive their value from an underlying asset such as Stocks bonds indices foreign currencies and even commodities. Options Calculator is used to calculate options profit or losses for your trades. When you buy a call option it gives you the option to buy shares at the agreed upon strike.

Join The Worlds Largest Investing Community. Call option profit or loss 3500 150 3500 Call option profit or loss 3500 3650. Call Option Calculator Call Option Calculator is used to calculating the total profit or loss for your call options.

Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. Options profit calculator will calculate how much you make and the total ROI with your option positions. Open an Account Now.

This tool can be used by traders while trading index options Nifty options or stock. There are basically two kinds of. Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

With the SAMCO Option Fair Value Calculator calculate the fair value of call options and put options. Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Ad Discover Call Options Calculator at Seeking Alpha - Giving Power to Investors.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Payout And Profit To Call Option At Expiration Call Option Business Tips Option Trading

Trading News Option Trading Stock Trading Strategies Stock Options Trading

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Binomial Option Pricing Calculator Option Pricing Pricing Calculator Real Time Quotes

Understanding The Binomial Option Pricing Model

Forex Compounding Forex Trading Jim Brown South African Forex Millionaire Forex Calculator Compo Trading Charts Stock Trading Strategies Stock Trading

Option Pricing And The Option Greeks Options Trading Strategies Stock Options Trading Finance Investing

Lic S Delhi Jeevan Lakshya Table 833 Details Benefits Bonus Calculator Review Example Call 919560214 Life Insurance Corporation Participation Life Insurance

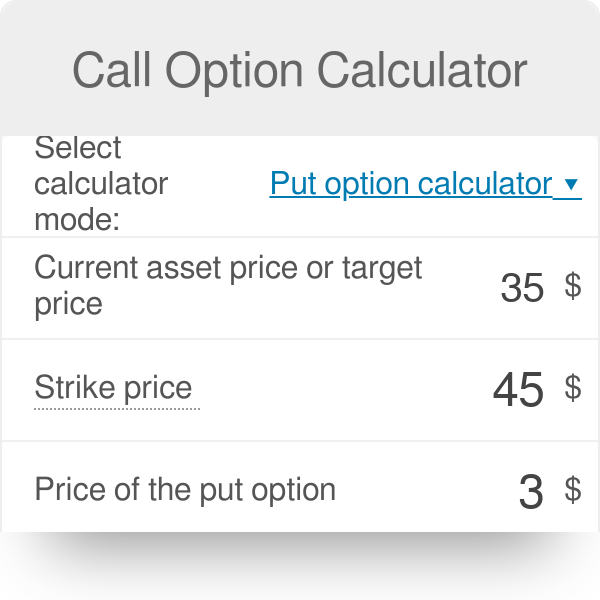

Call Option Calculator Put Option

Nifty Option Greeks Calculator Live Excel Sheet Trading Tuitions Option Trading Option Strategies Stock Options Trading

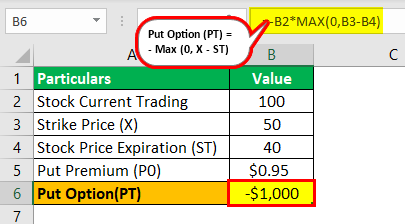

Put Option Meaning Explained Formula What Is It

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Digital Options Synonyms Binary Options All Or Nothing Options Cash Or Nothing Options Asset Or Nothing Options Pays A Set Payoff Options Market Options

The Options Industry Council Oic Options Pricing

Options Strategy Payoff Calculator Excel Sheet Option Strategies Payoff Strategies